This page was last updated in April 2025.

Library | Qualified Intermediary explainers and references

Welcome to our Qualified Intermediary library. Scroll down for explainers on:

What is the Qualified Intermediary (QI) regime about?

Significant benefits for QIs

Various QI capacities or ‘roles’

What is the Qualified Derivatives Dealer (QDD) regime about?

Financial risks and stringent compliance requirements

Three key challenges for QIs.

Click for information on:

Quick references:

For quick links to specific IRC sections or explainers on the various US withholding tax chapters, go to our U.S. withholding tax and information reporting library page.

What is the Qualified Intermediary regime about?

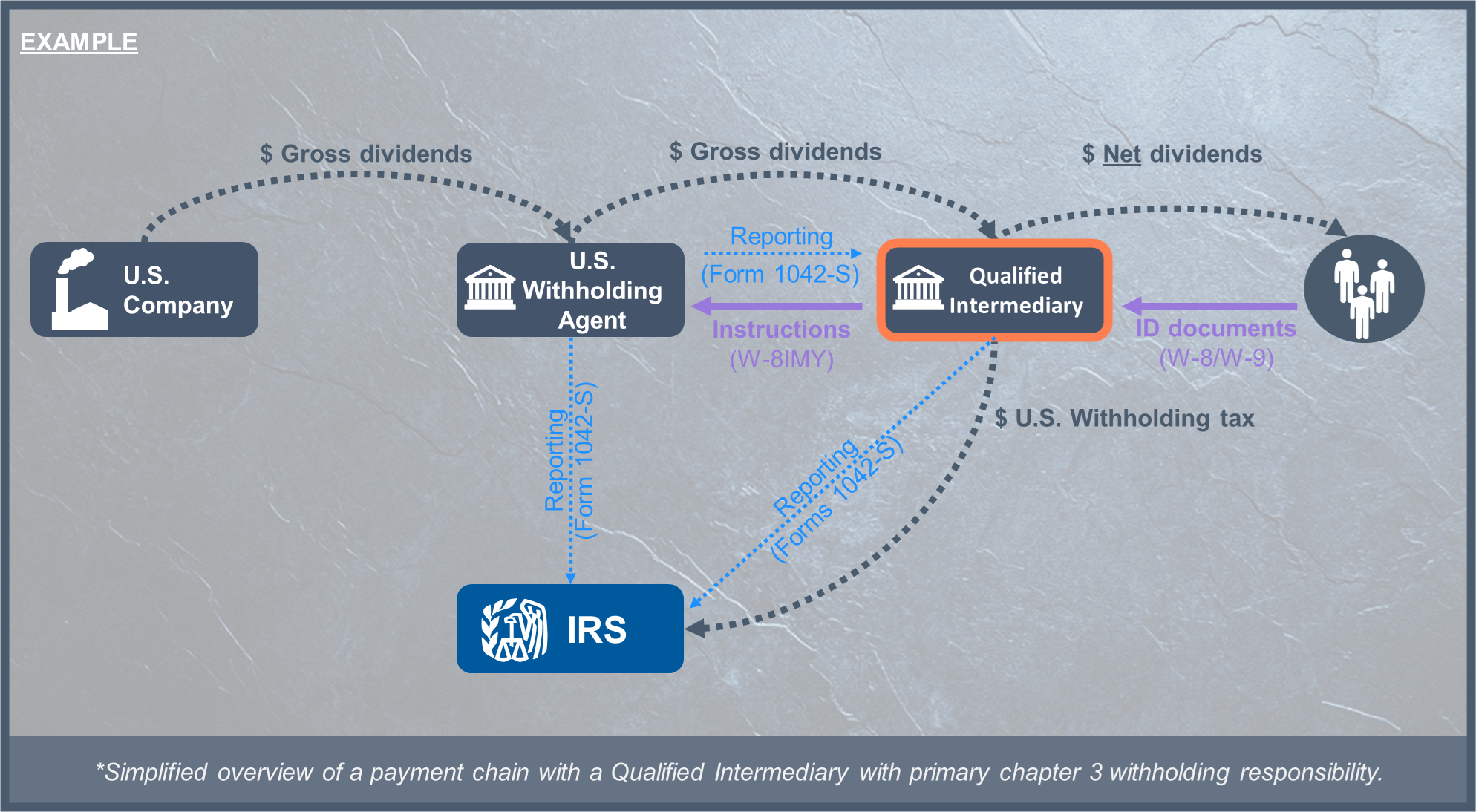

The QI regime allows non-U.S. financial intermediaries to opt-in as withholding agents for U.S. withholdings taxes and information reporting. The QI status is based on a contract – the ‘QI agreement’ - entered with the U.S. Internal Revenue Service (IRS). Most large and mid-size and some smaller European banks, brokers and custodians are QI.

The QI status influences how an intermediary processes payment of US-source income for non-U.S. clients, as well as how to handle U.S. clients and counterparties. The earliest QI model agreement is over 20 years old. The latest QI model agreement, set out in Internal Revenue Procedure 2022-43 came into effect 1 January 2023.

The QI regime offers significant competitive benefits for retail, private banking, and wealth management segments.

QIs are:

-

by assessing the applicable tax rate for each customer and ensuring that this tax rate is applied at moment of payment of the U.S. taxable income.

-

by sharing the information in an aggregated anonymous and manner with financial institutions up in the payment chain and the IRS.

-

from in scope U.S. source income payments and apply collective refund, reimbursement, and set-off procedures on behalf of customers via the QI’s annual Form 1042 reporting.

Various QI capacities or ‘roles’ may apply

For most taxable payments, QIs can choose whether to act as a QI and in which capacity. This choice determines the QI’s tax withholding and reporting responsibilities. For certain types of U.S. income—like substitute dividends, substitute interest, and income from Publicly Traded Partnerships—only specific agent roles are allowed. In situations where the customer is a U.S. citizen or resident, a QI may be required to assume a certain withholding and reporting agent role.

What is the QDD regime about?

Financial intermediaries and investment firms trading in structured products or derivatives with US-linked equity can obtain Qualified Derivatives Dealer (QDD) status. This status allows them to receive US dividends and so-called section 871(m) Dividend Equivalent payments without US withholding tax. Instead, a QDD must calculate and apply the appropriate withholding tax rate when paying-out Dividend Equivalent payments to their counterparties. The technical requirements to execute these withholding tax obligations are complex, in particular when counterparties are entitled to rates other than a 0% or the maximum 30% tax rate.

Financial risks and stringent compliance requirements

QI status is not to be obtained lightly. When withholding tax and reporting requirements are not - properly managed, fully understood or identified - a QI may incur significant financial risks. A QI is liable for US withholding tax it failed to withhold on payments to its customers plus penalties. Often automatically, penalties also apply for late or incorrect reporting.

To ensure that these risks do not occur QIs must implement and maintain a stringent compliance framework. The performance of this framework is subject to a periodic review and certification.

The QI compliance framework must contain adequate:

-

including controls to prevent, or recognize and resolve, instances where insufficient tax has been withheld and deposited or insufficient amounts have been reported to the IRS.

-

to enable the QI to effectively meet its customer identification, tax withholding and reporting obligations. The extent and maturity of the systems setup may vary depending on the QI’s size and business profile, though it must be adequate and minimize human error. A combination of data driven controls and statistical testing may be desired to recognize errors and omissions.

-

staff working on QI related processes must be sufficiently trained on US withholding tax rules to day-to-day execute QI obligations.

Policies and procedures should cover the following key processes:

| Product analysis |

|---|

| continuously capture new and changed products for US withholding tax and reporting impact. |

| Customer due diligence |

|---|

| continuously identify new customers and act upon their changes in circumstances to ensure that the correct US tax rate is applied. |

| Communication upstream agents |

|---|

| frequently inform upstream agents of the applicable US tax rate or re-allocate securities to accounts with different withholding tax rates. |

| Withholding and depositing of tax |

|---|

| continuously withhold the correct tax from customer payments, deposit it with the IRS, and regularly reconcile incoming and outgoing payments to ensure all amounts are accounted for and no tax is missed. |

| Annual reporting |

|---|

| annually report to the IRS via Form 1042, Forms 1042-S, and, if applicable, Form 945 and Forms 1099. Reconcile payments and reporting data, possibly with IRS transcripts, to ensure high-quality information. |

Three key challenges for Qualified Intermediaries

The QI regime is a high-stakes, complex and often necessary regime. Customer tax operations teams regularly struggle to sustainably manage US withholding tax, mitigate risks, and maintain operational efficiency across the organization.

Some key challenges include:

1. Complex detailed rules

The US withholding tax rules are part of a complex rule-based system of law that is difficult to interpret and translate to business operations, while tailored policy and control decisions are needed to mitigate financial risk across differing business segments, product lines and client categories. This challenge grows with additions of new rules, such as the Publicly Traded Partnership provisions.

2. Governance challenges

Operational tax teams are dependent on internal teams and external parties to ensure QI compliance. Problems for example arise when new products aren’t fully assessed for US withholding tax implications, or when upstream agents provide inaccurate data, or provide data to late, causing errors in withholding and reporting. The time-sensitive nature of US withholding tax compliance is often overlooked and under-prioritized.

3. Limited availability of qualified staff

Across the EU and beyond tax professionals are usually not trained on US withholding tax rules, while tax professionals in the US are not always aware of the specifics of the QI agreement and the interaction with local corporate law, know-your-customer rules and data privacy restrictions.

This list of challenges is not exhaustive; many other significant issues exist that may be of higher importance for your organization.